Отказ от ответственности: представленная информация не является финансовым, инвестиционным, торговым или другим советом и является исключительно мнением автора.

- FTM could continue with its downtrend momentum.

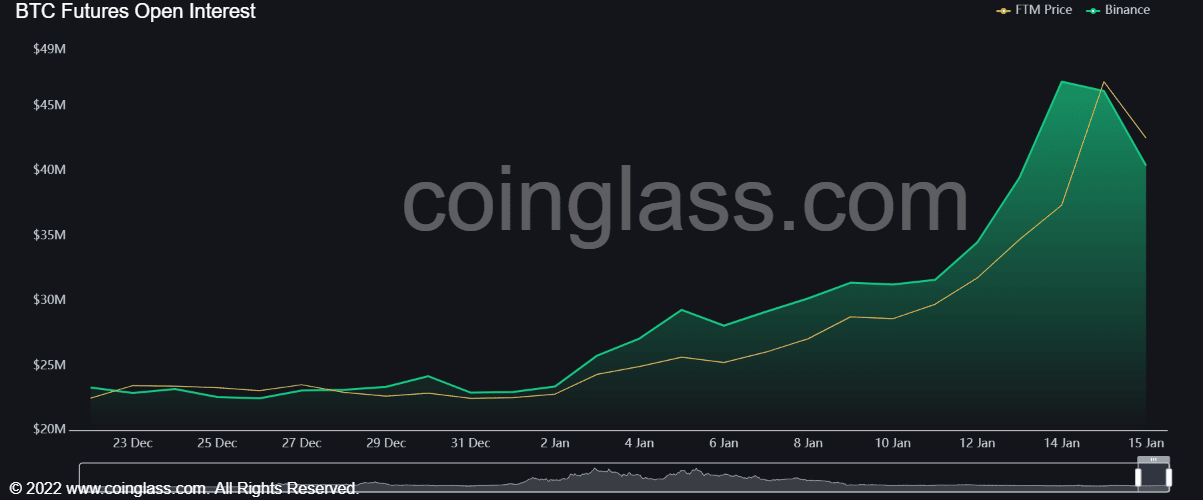

- FTM recorded a decline in open interests in the futures market.

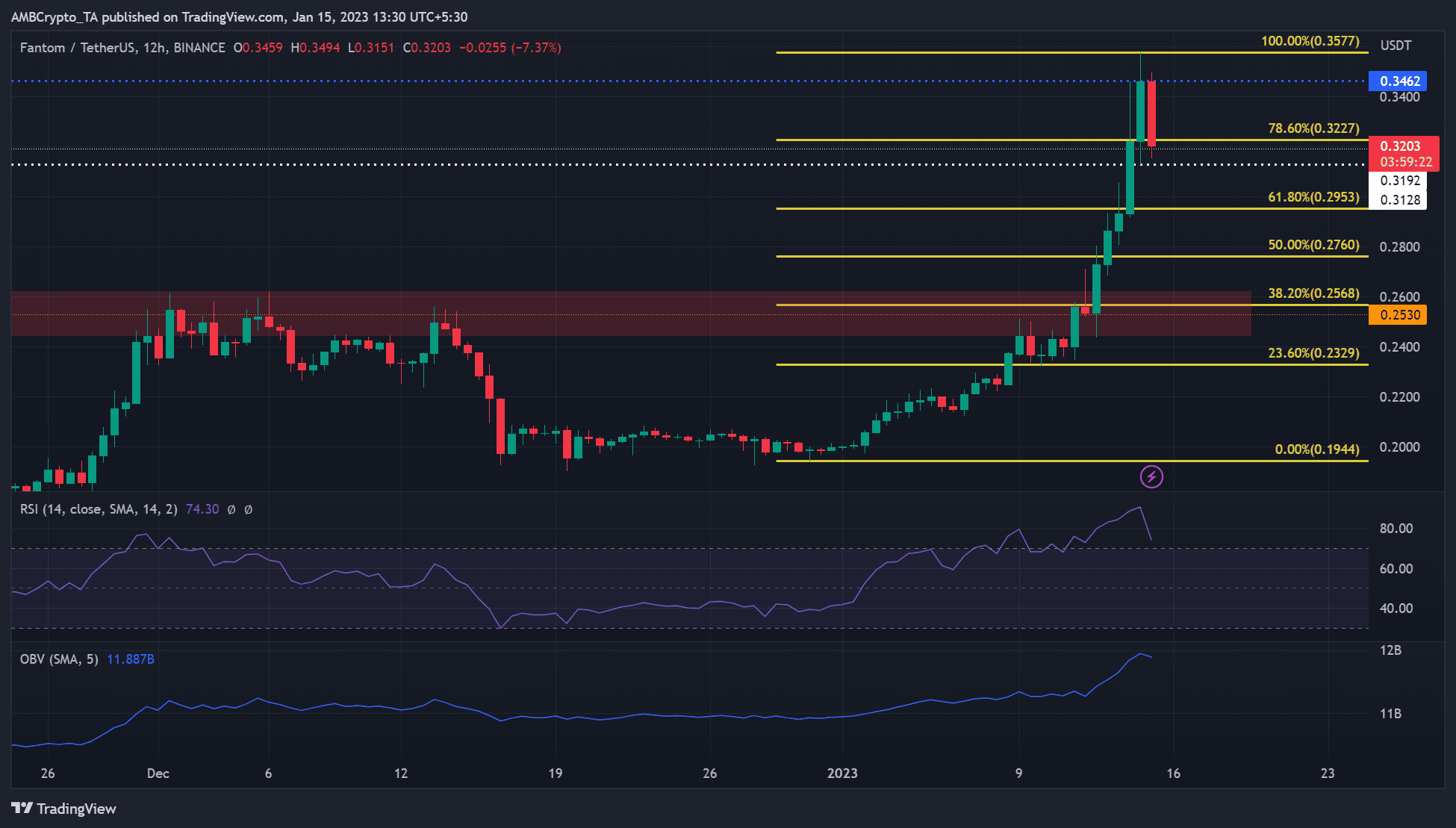

Фантом [FTM] offered over 80% gains after rallying from $0.1940 to a high of $0.3577. However, the rally seemed to cool off after FTM faced a price rejection at $0.3462.

At press time, FTM was trading at $0.3203 with a possibility of a further downtrend if more bears came on board.

Читать Прогноз цены Fantom [FTM] 2023-24

Поддержка $0.3128: удержится ли?

FTM’s 12-hour chart showed the Relative Strength Index (RSI) had sharply dropped but was still in the overbought zone. This indicated a sharp decline in buying pressure as holders sold off their holdings to lock in gains.

Similarly, the On Balance Volume (OBV) exhibited a slight decline after a massive uptrend recently. It shows that trading volume dropped slightly after bears moved in.

Given that the overbought condition makes an asset ripe for trend reversal, FTM’s current downtrend could continue. This could see bears push it to retest the $0.3128 support. But a break below the support could be feasible if the BTC uptrend also reverses in the next few days.

However, the downtrend momentum could be kept in check by the 61.8% Fib level of $0.2953. Therefore, $0.3128 and $0.2953 could be short-selling targets if the FTM downtrend picks pace in the next few days/weeks.

Alternatively, bulls could push FTM above $0.3462 if BTC is bullish, invalidating the above bearish bias. Such a move could allow bulls to target $0.3577.

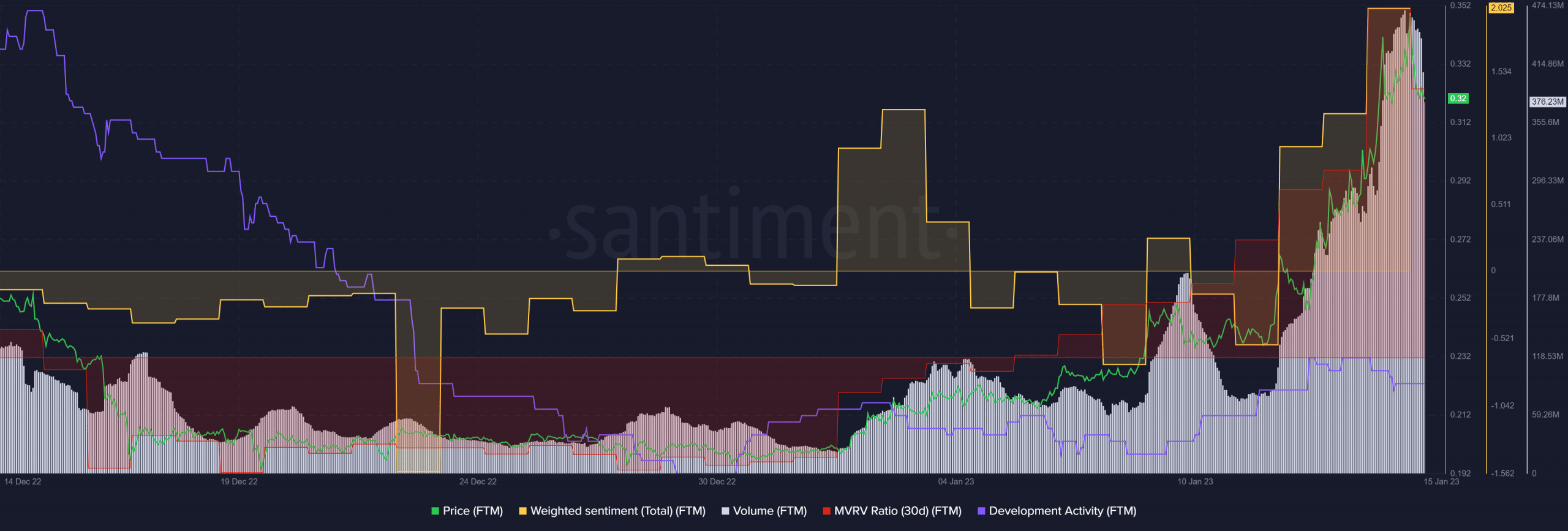

FTM’s weighted sentiment was positive, while open interest fell sharply

FTM’s weighted sentiment was positive at press time, showing analysts were still bullish on the asset. Besides, the recent uptrend saw short-term holders make gains, as evidenced by a positive 30-day MVRV. But long-term holders incurred losses.

Ваше портфолио зеленое? Проверьте Калькулятор прибыли FTM

However, FTM’s open interest (OI) seemed to have peaked after a steady rise since the beginning of the year. The OI declined in tandem with the price, a likely show of confirmed trend reversal as more money flowed out of FTM’s futures market. This could indicate that FTM may witness further price drop.

The weighted sentiment showed a bullish outlook, while the futures market leaned towards a bearish FTM. That’s a mixed signal. Therefore, BTC’s price action can offer investors a more accurate prediction of FTM price movement.

As such, if BTC breaks below $20.15K, FTM could breach the $0.3462 support and advance southwards to $0.2953. However, BTC’s move beyond $21.23K could incentivize FTM bulls to overcome the $0.3462 hurdle and retest its overhead resistance at $0.3577.

Source: https://ambcrypto.com/ftm-bears-gain-leverage-after-a-rejection-of-0-3462-is-it-right-time-to-sell/