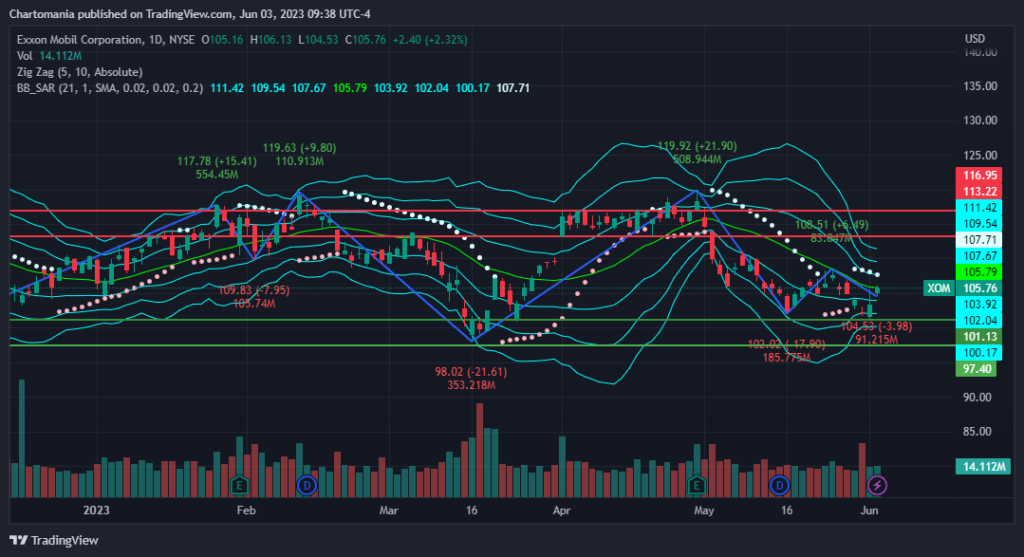

On the June 2, 2023 trading session, XOM Stock surged more than 2.30% and closed at $105.76. In the same trading session, the company’s stock opened trading at $105.16, and after hitting a high of $106.13 and a low of $104.53, it closed 2.32% up compared to June 1 trading prices.

On the June 2, 2023 trading session, XOM Stock surged more than 2.30% and closed at $105.76. In the same trading session, the company’s stock opened trading at $105.16, and after hitting a high of $106.13 and a low of $104.53, it closed 2.32% up compared to June 1 trading prices.

In the last three trading sessions, XOM Stock recorded an impressive hike. It is important to note that the trading prices of XOM Stock downgraded around 3.04% in monthly trading and 3.90% in quarterly trading sessions.

As per indicators, it might be a good time to buy or hold XOM stock. Technical indicators do not suggest purchase or sale; it suggests a neutral opinion. Analysts’ price target for one year is $127.10.

Earning and Revenue of ExxonMobil

In the last few quarters, ExxonMobil Corporation reported more revenue than the estimate, excluding Q2 2022. Similarly, in Q1 2023, the company’s reported revenue was $86.56 Billion, 1.07% more than the estimated figures.

Earning Per Share surged by around 8.86% in Q1 2023 and has shown constant growth in the last few quarters. The overall market capitalization of ExxonMobil at press time was $427.58 Billion.

TradingView says more than 99% of ExxonMobil shares are free-floating, and 0.19% are closely held. From the total revenue, the company’s gross profit is 26%, net income is 14%, and the remaining is EBITDA and EBIT.

ExxonMobil generates the majority of revenue from the Energy sector by selling their products in no U.S regions, and 29% of income is from the United States and surrounding areas.

ExxonMobil majorly exports its products to Singapore, France, Italy, Australia, Canada, the United States, Belgium, and a few regions. In 2022 company’s revenue dropped by 2.88% and reported $12.26 Billion less revenue than estimated figures.

Exxon Mobil acquired Jurong Aromatic Corporation for more than $2 Billion, XTO Energy for $41 Billion, Celtic Exploration Ltd. for $2.64 Billion, InterOil Corporation for $2.5 Billion, and MPM Lubricants for an undisclosed sum on December 14, 2009.

Нефтегазовая компания вложила значительные средства в Бразилию и продолжит изучать возможности роста и расширения в этой южноамериканской стране.

Major competitors of Exxon Mobil in the global market include Shell, Saudi Aramco, PetroChina, Chevron, China Petroleum & Chemical Corporation, etc.

Major subsidiaries of Exxon Mobil are XTO Energy, Tengizchevroil, Imperial Oil, Esso Public Company Limited, SeaRiver Maritime, Aera Energy, and Exxon Neftegas.

Отказ от ответственности

Взгляды и мнения, изложенные автором или любыми людьми, упомянутыми в этой статье, предназначены только для информационных идей и не являются финансовыми, инвестиционными или другими советами. Инвестирование в криптоактивы или торговля ими сопряжены с риском финансовых потерь.

Source: https://www.thecoinrepublic.com/2023/06/03/xom-stock-jumped-over-2-30-intraday-buyers-on-the-verge/